"Syndicator Series" is a limited interview series showcasing a curated group of top tax credit syndicators and their groundbreaking work. Designed to connect banks, syndicators, and community development leaders with the innovative ideas and projects shaping the future of tax credit equity.

In this feature, we’re thrilled to spotlight Tony Bertoldi, Chief Executive Officer of CREA. Tony is actively involved in various industry organizations, serving on the board and executive committee for the Affordable Housing Tax Credit Coalition, as well as the board of CREA Foundation, Inc. He is also a member of the National Housing Crisis Task Force and frequently speaks at industry events. In January 2024, Forbes published Tony's debut book, American Dream Come True: Why Affordable Housing Is Good Policy, Good Business, and Good for America.

Can you briefly describe your professional role and the journey that brought you to today?

In January, I assumed the role of CEO for CREA, LLC where I have worked for the past 15 plus years. I was at another tax credit syndicator in the Boston area prior to joining CREA and before that, I did some work with the tax credit consulting group at E&Y under the direction of Fred Copeman. All told, I have approximately 30 years of experience in the business, the vast majority of it at a national tax credit syndicator.

What aspects of your work bring you the most excitement or fulfillment?

I think the response here is two fold. Like many of us in this business, I am a bit of a deal junkie and I still have excitement around individual deal closings as well as fund closings, most notably our flagship multi-investor national funds that are some of the largest in the industry. There is a tremendous team effort that goes into every closing and the sense of comradery and satisfaction at the closing makes it all worthwhile.

On the other hand, if you have ever visited a LIHTC property and met some of the residents whether it be a family, single mom, veteran, or someone who previously experienced homelessness, you can see the real value of what we do—providing a clean, safe, affordable place for everyone to lay their head at night. That is really why we all do what we do.

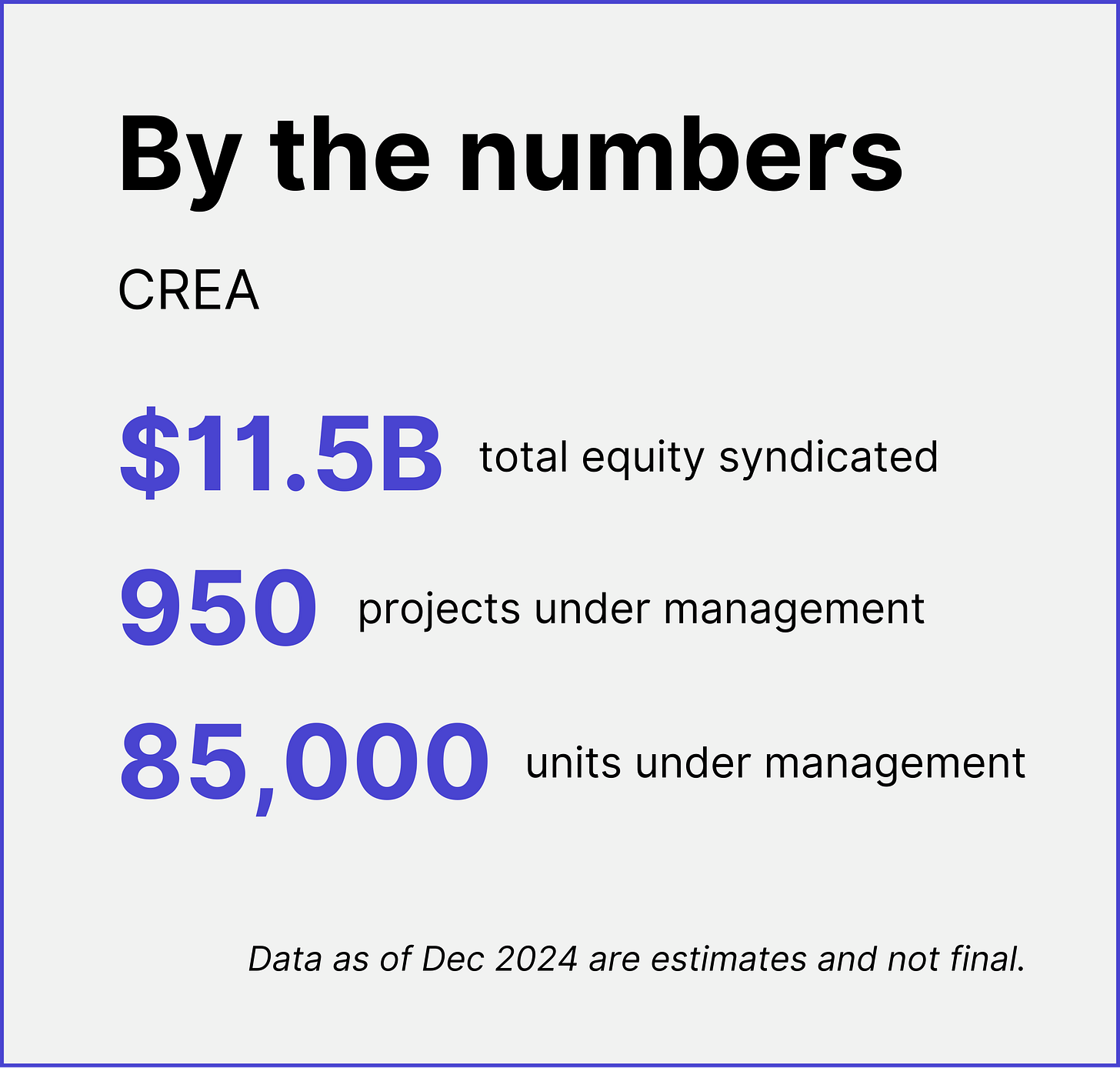

CREA’s Key Metrics

We are truly a national syndicator. We have closed investments in 48 states (with one more state about to be added) and the US Virgin Islands. We are also close to signing deals in Saipan, Guam and potentially Puerto Rico. And while it is not our goal to simply be in every state and territory, it speaks to our vast network of investor and developer clients across the country.

Could you share a favorite deal or project you’ve worked on and why it stands out?

John Arthur Flats in Cincinnati, Ohio. Named after John Arthur (from Cincinnati), who, with his husband Jim Obergefell, was at the heart of the contentious legal dispute that went to the US Supreme Court and ultimately legalized gay marriage. John Arthur Flats is the first of its kind in Cincinnati and one of only a few across the country designated for the senior LGTBQ+ population. As a gay, married man myself, it was with immense pride and honor to be involved in this development and to attend the grand opening.

Note: The new construction community includes 57 one and two bedroom units and was opened November 2022.

How do Community Reinvestment Act (CRA) regulations shape or influence your work?

It is estimated that roughly 70% to 80% of the equity in the LIHTC market is from the banking industry and that industry is regulated by CRA. It has been a tumultuous few years with new regulations out of The Office of the Comptroller of the Currency (OCC) under the Trump administration's first term, only to be pulled back by the Biden administration and a new set of regulations promulgated. These regulations are now subject to an injunction. The CEOs and compliance officers of banks are spinning trying to make heads or tails out of this and how it impacts their policy and investment goals. Oddly, investments in LIHTC have been somewhat stable as banks just continue to do what they believe they need to do while the regulations shift. Regardless, CRA is one of the most influential regulations for this business and we will be watching it closely.

What trends have you observed in how community and regional banks participate in tax credit investments?

As mentioned, it has been relatively steady as the implementation of the regulations are staged and pulled back while the banks revert back to doing the same as they always have. I personally am very interested to see what position the Trump administration takes on CRA.

What are your predictions for your business and the broader tax credit syndication industry in 2025?

The opportunity and the challenge are the same in 2025—preservation and expansion of the LIHTC. President-elect Trump and his administration will most definitely focus on a tax package next year as his Tax Cuts and Jobs Act of 2017 expires at the end of 2025. Many are calling this the “Super Bowl of Tax”. On the one hand, we will fight to make sure the LIHTC program is preserved and on the other, we will have the opportunity to expand it. Unfortunately, we have gone several years without expansion or increase to the LIHTC. Other than Consumer Price Index (CPI), the cost and supply of housing is America's number one issue.

We'll also be keeping an eye on the 10-year treasury as it greatly impacts the pricing of debt on LIHTC deals, particularly the bond deals. It is also a benchmark for investors in setting yield requirements. The deal sizing can put a strain on deals and make some infeasible while higher yield requirements put a strain on property level pricing for the credits, which can also put a strain on the sources and uses.

Which industry events do you plan to attend in 2025, and what makes these events valuable to you?

I sit on the board and executive committee of the Affordable Housing Tax Credit Coalition (AHTCC) and will attend their three events—two of which will be in D.C. We'll use that opportunity to visit the Hill and advocate on behalf of the LIHTC. At CREA, we typically have a large showing at several other industry-wide events such as NCSHA, AHF Live, AHIC in the Fall and several other state conferences such as NYSAFAH and TAAHP. At these conferences, we have the opportunity to meet and spend time with many of our partners and service providers, all jammed into a few days of meetings and social events.

The syndication space is full of acronyms. What are your favorite, most confusing, or most amusing acronyms or industry-specific terms?

There certainly are many acronyms, and just as much jargon. I think certain syndicators and participants also develop their own set of jargon, or a subset. I know here at CREA, we have developed our own software to monitor pipeline and fund level activity which includes an entire language of property and fund level statuses that are likely gibberish to the outside world.

I learned of my favorite new acronym through a property that we are restructuring. The acronym is BOLI, Bureau of Labor and Industries. Among other things, it administers Oregon wage levels for certain contracts such as Davis Bacon wages (or prevailing wages, in our industry). The full name is somewhat unremarkable but I always crack a little smile when I hear the cheery acronym BOLI. Pronounced boo-lee. The acronym sounds much more fun than I assume the activities of the actual bureau (but we are thankful for their work!).